Content

If you want to move tokens from one blockchain to another, you’ll likely need a blockchain bridge to allow those assets to travel. The two-way bridge allows you to freely trade assets between different blockchains. In addition to the direction in which bridging allows you to freely send and receive assets, the custodian of bridging also changes, or who controls the assets used to create bridging assets.

Bridge services “wrap” cryptocurrency to convert one type of coin into another. So if you go to a bridge to use another currency, like Bitcoin , the bridge will spit out wrapped bitcoins . It’s like a gift card or a check that represents stored value in a flexible alternative format. Bridges need a reserve of cryptocurrency coins to underwrite all those wrapped coins, and that trove is a major target for hackers.

Each blockchain project has its own defining parameters, often resulting in a lack of interoperability between other networks. Seamless transfer of assets to and fro different blockchain networks can also help developers overcome conventional barriers in dApps development. As the popularity of blockchain applications such as DeFi apps, NFTs and DAOs continue to grow; bridges can offer seamless user experiences. Dive deeper into the domain of web3 and find out the significance of a blockchain bridge for the future now.

The Workings Of A Blockchain Bridge

While bridges unlock innovation for the blockchain ecosystem, they also pose serious risks if teams cut corners with research & development. The Poly Network hack has demonstrated the potential economic magnitude of vulnerabilities & attacks, and I expect this to get worse before it gets better. While it is a highly fragmented and competitive landscape for bridge builders, teams should remain disciplined in prioritizing security over time-to-market.

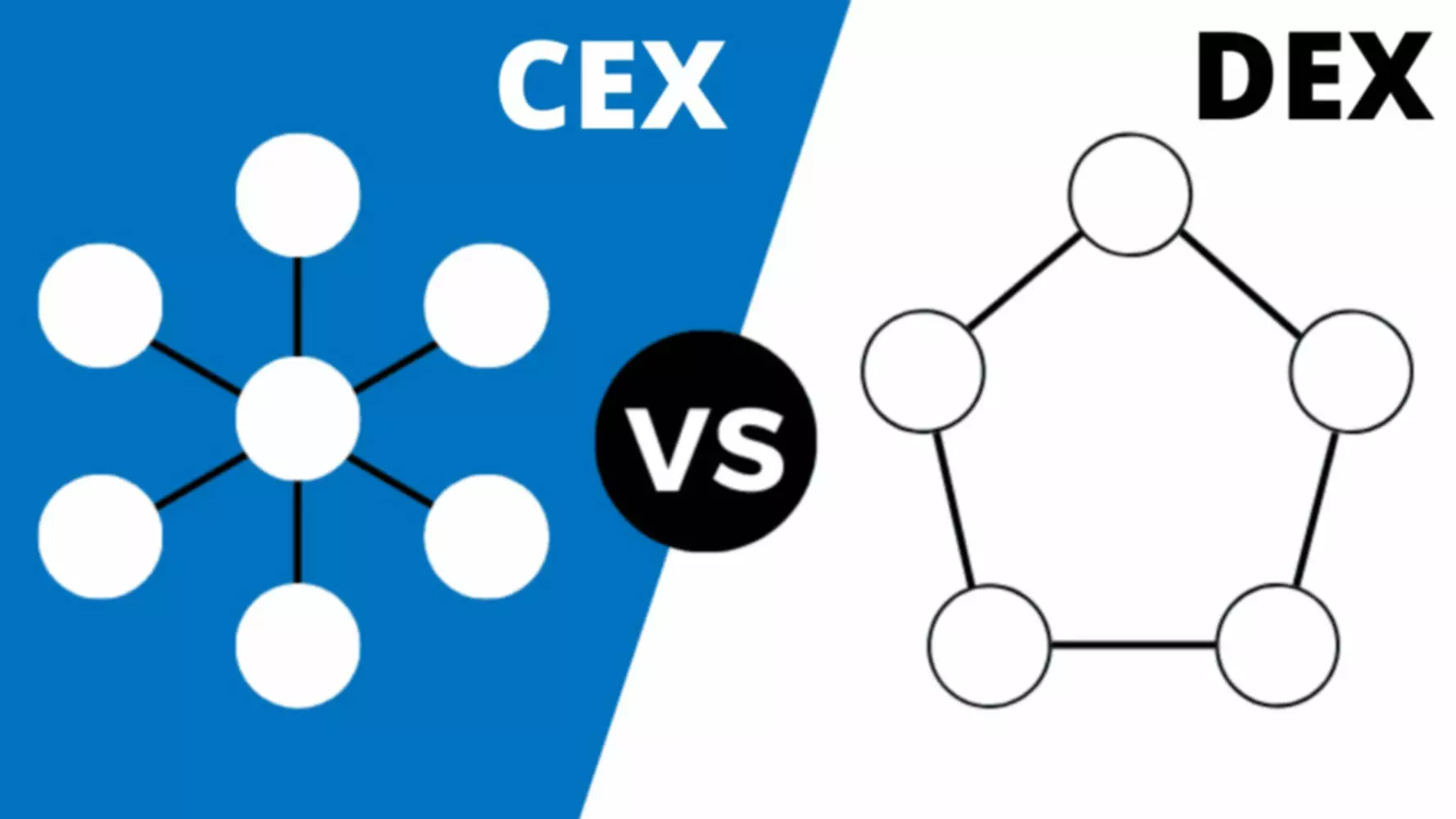

Thus, many blockchain projects are developed in isolated environments. That said, each blockchain network holds its own beneficial features for targeting demographics. Therefore, a popular solution to frictionless “chain-hopping” is a range of blockchain bridges that allow users the freedom to switch between networks with ease. A trusted blockchain bridge is a protocol run by a centralized system, entity, or operator. The reason for the term “trusted” is due to the users giving up the custody of their funds and trusting the reputation of a centralized bridge. Trusted blockchain bridges typically have user-friendly interfaces, ideal for onboarding new people to crypto.

Before Coinavalon, Aris worked as a Business & IT Architect in the financial services sector. Aris holds an MSc in Advanced Computing from Imperial College London, a BSc in Computer Engineering from University of Cyprus and currently pursuing an MBA degree from CIIM. To further enhance the user experience, these types of bridges can take it one step further, providing a DEX-like experience, and allowing cross-chain swaps, by connecting different AMM routes. It’s always important to do your due diligence when using a blockchain bridge.

Binance ‘narrowing Down’ Identity Of $570m Smart Chain Bridge Attacker

Imagine you have Solana island, where tokens on the Solana blockchain like Solana and Serum operate. Then, you also have Ethereum island, where ERC-20 tokens like ETH and Chainlink exist. There are thousands of cryptocurrencies out there, and new projects spring up all the time. For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. CultOfMoney.com strives to keep its information accurate and up to date.

List of blockchain bridges focused on addressing unique user requirements. Here is an outline of the notable blockchain bridge variants you can use for transferring assets and information between blockchain networks. How blockchain bridges work” by reflecting back on the basics of blockchain. Blockchain networks include a global community of nodes interacting with other in a shred environment for management, validation and storage of financial transactions and data exchanges. The distinct traits of the blockchain networks separate them from one another and create distinct communities. For example, each blockchain network features a consensus model, which is an integral component for ensuring that all nodes can agree on specific transactions.

Blockchain Bridge

For example, Bitcoin becomes a wrapped Bitcoin upon being transferred to the Ethereum blockchain via a blockchain bridge. The amount of Bitcoin sent for the transfer will correlate with the amount of wrapped Bitcoin minted on the Ethereum network. The wrapped Bitcoin also functions as an ERC-20 token, which allows it to be used in the Ethereum ecosystem, including for NFTs as well as DeFi platforms.

Rather, blockchain bridges typically use a mint-and-burn approach with smart contracts or centralized pools to give you an equivalent token representation on different chains. Bidirectional bridges are another example of a blockchain bridge variant, working exactly opposite to the functioning of unidirectional bridges. A bidirectional blockchain bridge helps in ensuring seamless transfer of assets and information between two networks. Therefore, bidirectional bridges serve as a favorable alternative to using two different unidirectional bridges.

The advantages of a blockchain bridge can offer benefits to developers and investors alongside the blockchain networks connected by the bridge. Blockchain bridges can offer better opportunities for increasing the number of users and more opportunities for development and transfer of assets. The second variant among bridges for blockchain networks would refer to a trustless blockchain bridge. As compared to a trusted blockchain bridge, the trustless variant leverages algorithms and smart contracts over a blockchain network. Therefore, a trustless blockchain bridge does not need any central intermediaries or custodians.

Blockchain

Your WBTC can buy any other Ethereum-based tokens, including NFTs and other cryptocurrencies that are built on the Ethereum network. ChainX, a crypto assets gateway, is planning bridges to several networks and has implemented a BTC-to-Substrate bridge. Zhao said Monday that up to 90% of the stolen funds were frozen on the blockchain before they could be moved. And now the company, which runs the world’s largest centralized crypto exchange, has had some help tracking down the responsible party. Blockchain bridges are a crucial piece of the cryptocurrency ecosystem, which makes them prime targets for attacks. Trust-based bridges are fast and an economical option when you want to transfer a large amount of crypto, but the pool of reliable services is rather small.

However, there are certain blockchains where, if you want to transfer from, you can only go to a specific destination. This decentralized bridge What is a Blockchain Bridge And How it Works offers one of the largest selections of tradable cryptocurrencies. It supports popular blockchains like Ethereum, Solana, TRON, among others.

- Blockchain bridges can do a lot of cool stuff like converting smart contracts and sending data, but the most common utility is token transfer.

- But Polkadot also allows parachains and external networks like Bitcoin or Ethereum to interoperate via bridges.

- Imagine different banks worked in silos with no integration between any of them.

- Once connected to a wallet, you can see all of your balances across different types of coins.

- For example, trusted blockchain bridge presents the concerns of censorship due to centralized control.

- A blockchain bridge, sometimes known as a “cross-chain bridge”, allows the seamless transfer of assets and data between two distinct protocols.

- A bidirectional blockchain bridge helps in ensuring seamless transfer of assets and information between two networks.

In addition, the risks with a blockchain bridge depend on the type and have a different impact on users and the blockchain community. Using a blockchain bridge means you can transform your existing crypto into something capable of operating on other networks from the security and privacy of your own, custodial wallet. Instead the power to operate across networks can be achieved on a decentralized basis. A bridge running as a parachain on Polkadot may have collators monitoring and translating the information between the Polkadot Relay Chain and an external chain, for example, Bitcoin.

Assets of blockchain networks are usually created by a specific protocol for use within that particular blockchain only. With a blockchain bridge, a wrapped token — mimicking the characteristics and functions of the target token — is generated the moment it reaches the target blockchain network. Blockchain bridges, also known as network bridges, are applications that allow people to move digital assets from one blockchain to another. Blockchain bridges enable users to access the benefits of different blockchain technologies without having to choose between platforms. This not only helps take pressure off of Ethereum, the most popular DeFi network, but also invites innovation in other ecosystems without necessitating a winner-takes-all mentality. At a time when the Lego-like composability of decentralized finance applications is changing the face of financial services, it’s more important than ever for independent blockchains to “communicate” with another.

List Of Top 10 Richest Crypto And Blockchain Billionaires

This is the reality of cryptocurrency, and there are plenty of crypto and NFT scams out there as well as the threat of hackers. After all, the flexibility this technology provides is extremely useful for avid investors. But before you invest across multiple chains, it’s important to understand exactly how blockchain bridges work and why this technology is critical for crypto’s success. When you go to “bridge” your crypto, your current asset is actually “Frozen” through a smart contract.

Another variable option when using a blockchain bridge is the direction of transactions. For example, a unidirectional blockchain bridge can allow the transfer of assets from network A to network B; however, assets cannot be converted back from network B to network A. As the name suggests, a unidirectional blockchain bridge only works in one-way conversions. As investors venture into the decentralized finance landscape, the need to use a blockchain bridge becomes increasingly commonplace. Akin to physical bridges that allow people to cross from one landmass to another, a blockchain bridge connects two different blockchain ecosystems.

Sidechain Bridges

A prime example is Ethereum, which still faces serious scalability issues, resulting in huge fees even for small transactions. All developers and users on the Ethereum blockchain are forced to face these problems every time. However, the transition to faster and cheaper networks, such as Polkadot, Solana, or Tezos, threatens with the loss of a large, established community and infrastructure. From a developer’s point of view, integrating a blockchain bridge into an application can be a valuable move.

We may be inching toward an innovative and normalized crypto economy, but any progress is better than limiting ourselves to what already exists. Aris created Coinavalon with the purpose of helping the average person navigate the decentralized web. Aris has been passively in the space since 2017 and full time since late 2020.

If you operate with one bank and your friend operates with another, trying to move money across to the other would not only be a headache, but it might be downright impossible. Without interoperability, working across networks would simply fail. For this reason, interoperability – and the lack thereof – is one of the biggest problems blockchains are facing at the moment. Cross-chain message passing Several bridges have already been built or are in development in the testnet stage for the Polkadot ecosystem.

Furthermore, a trustless bridge entrusts the responsibility of assets to the users, thereby implying possibility of a loss of funds due to user error. Blockchain bridges establish a credible impression of how they are important for the future of blockchain. Bridges offer a promising tool for hopping between different blockchain networks seamlessly.

Users need to give up control of their coins if they wish to convert them to other crypto, essentially trusting it in the hands of someone else. If you’ve ever seen a wrapped token, such as wBTC, it’s the result of this process. The idea here is that they take your BTC and “wrap” it in an ERC-20 contract, giving it the functionality of an https://xcritical.com/ Ethereum token. This type of bridge avoids the problem of creating wrapped tokens, however, it faces the challenge of attracting adequate liquidity to enable the transfers as well as finding assets that are native on multiple chains. This type of market structure necessitates the need for interoperability between these distinct networks.

Choosing A Bridge

From general-purpose blockchain networks, all the way to special-purpose blockchains – built to address a specific need. Light clients & relays are also strong with statefulness because header relay systems could pass around any kind of data. They are also strong with security because they do not require additional trust assumptions, although there is a liveness assumption because a relayer is still required to transmit the information. These are also the most capital-efficient bridges because they do not require any capital lockup whatsoever. For each chain pair, developers must deploy a new light client smart contract on both the source and destination chain, which is somewhere between O and O complexity .

Choosing a particular blockchain as a platform for their application limited developers from the benefits of other, alternative protocols. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period.

The siloed nature of today’s blockchain networks goes against the principle of decentralization and re-establishes the Balkanization of the existing centralized web (often called Web 2.0). Blockchain technology has come a long way since 2008 when the Bitcoin white paper was published. Since then, an explosion of blockchain networks have been created, with a huge variety of designs and intended functionality.